We all know that the global financial landscape is turbulent and there’s a cost-of-living crisis that has applied added strains on everyone, including employees. In response, forward-thinking businesses are prioritising financial wellbeing as an essential part of their comprehensive wellness strategies. The urgency of this initiative is underscored by data: 37% of employees identify financial pressure as a key source of external stress.

But why should financial wellbeing support matter for businesses? Because financial stability among employees translates to increased productivity, higher levels of employee engagement and improved morale. So if you’re looking for ways to enhance the financial stability of your workforce, continue reading. We’re here for you with insights that could redefine your organization's wellness programs.

What Financial Wellbeing Means

Financial wellbeing at work is the practical assurance that employees feel secure and masterful over their earnings. Picture Sarah, an employee in your organization who juggles rent, childcare costs and a student loan. When her car breaks down unexpectedly, it's an inconvenience and financial strain that adds money worries to her workdays and distracts her from her tasks. This is financial wellbeing at its most critical junction: The ability to handle life's curveballs without spiraling into stress and underperformance.

The elements that contribute to financial stress are as varied as they are prevalent: family payments, rent or mortgages, addictions like nicotine or alcohol, impulse spending or health-related expenses. The key point here is that this stress doesn’t manifest itself in isolation, and it’s often linked with other aspects of wellness, be it physical or mental.

It’s why every employee should focus on providing financial wellbeing support — because when employees like Sarah face financial pressures, it manifests in their job performance. Struggles with finances equate to struggles with concentration, attendance and, ultimately, productivity. The repercussions of financial stress can manifest in physical illness too, leading to absenteeism and, by extension, reduced performance. In fact, 18 million working hours are lost to financial stress each year.

This makes it clear that promoting an environment of wellbeing is far from just a 'nice-to-have' and should rather be a foundational aspect of your business strategy. Investing in your employees' financial wellbeing is akin to investing in the organization's wellbeing — lifting employee engagement and, of course, the bottom line.

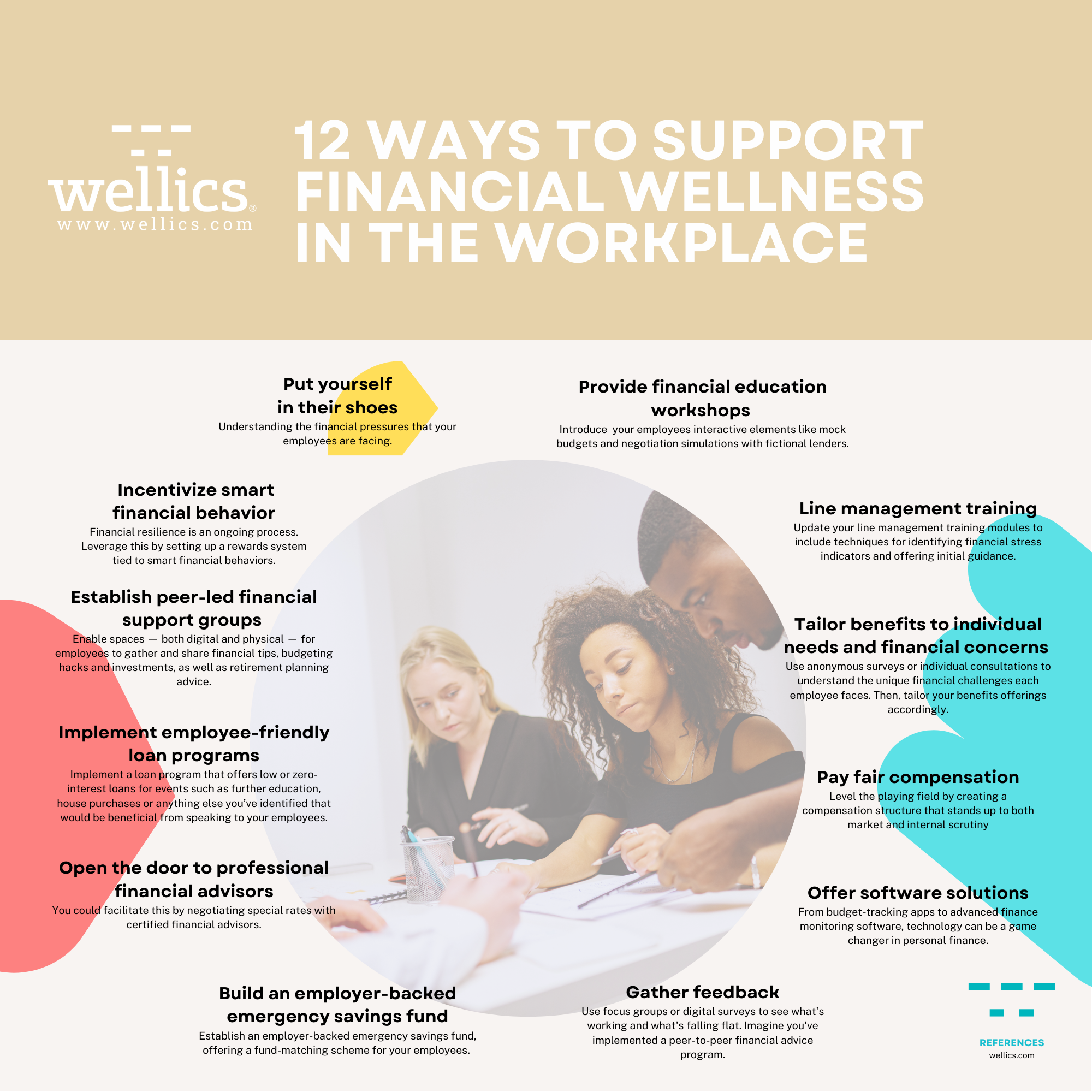

12 Ways To Support Financial Wellness in the Workplace

Alright, if you’re ready to take action but are not sure where to start, we’ve got some strategies for you. However, you don't need to do everything on this list to make a difference in your employees' financial wellness. Choose the strategies that make sense for your company and go from there. Now, let's dig into how you can make a real impact in your employees’ lives.

1. Put yourself in their shoes

Understanding the financial pressures that your employees are facing is step one. Consider doing one-on-one interviews or anonymous surveys to learn about the financial concerns your team grapples with daily. This way, you can tailor your support strategies to what they actually need, not what you think they might need.

2. Provide financial education workshops

You've been paying your employees, so why not empower them to make the most of their earnings? If you can, implement financial education workshops, or, if you already have them, take them up a notch by introducing interactive elements like mock budgets and negotiation simulations with fictional lenders. For instance, dedicate a workshop to the often-daunting subject of mortgages, equipping your team with specific strategies and actionable plans.

3. Line management training

As much as financial resilience is a personal endeavour, it also requires a concerted team effort, starting with your line managers. These are the people employees tend to turn to first when facing work-related stress, which, as we’ve established, frequently includes financial concerns. Update your line management training modules to include techniques for identifying financial stress indicators and offering initial guidance. Train your line managers to be able to direct staff to the appropriate financial resources or in-house workshops.

4. Pay fair compensation

Statistics speak loud and clear: Only 34% of employees believe their pay is fair. The direct consequence? Reduced engagement at work for the remaining 66%. Level the playing field by creating a compensation structure that stands up to both market and internal scrutiny. Moreover, transparency around pay scales and performance-based bonuses can go a long way in demonstrating fairness. The outcome you're aiming for is a workforce that feels valued for their contributions, which naturally reduces money worries and elevates morale as well as productivity.

5. Offer software solutions

Instead of leaving employees to wade through the complexities of financial management on their own, offer them a lifeline of specialised software solutions. From budget-tracking apps to advanced finance monitoring software, technology can be a game changer in personal finance. When you provide these tools, you go beyond just offering support; you empower your employees to take control of their financial health in real time, from the comfort of their own devices.

6. Gather feedback

Revisit, refine and revamp. Use focus groups or digital surveys to see what's working and what's falling flat. Imagine you've implemented a peer-to-peer financial advice program. After a couple of months, pull the data. Are people engaging? Are they finding it useful? Answer these questions to spot opportunities to fine-tune your approach for even better outcomes.

7. Build an employer-backed emergency savings fund

We know that when employees face financial crises, it ripples through your organisation in the form of decreased productivity and heightened stress. So here’s something else you can do to really elevate your efforts … Establish an employer-backed emergency savings fund, offering a fund-matching scheme for your employees. You could match a percentage of their contributions up to a certain amount, thereby turbocharging their ability to save for unexpected events like car breakdowns or family emergencies.

8. Open the door to professional financial advisors

Although access to expert advice and financial coaching is often a luxury reserved for the executive suite, it doesn’t have to be. You could facilitate this by negotiating special rates with certified financial advisors. Allow your team to sign up for these one-on-one sessions directly through your internal portal, and cover a portion of the cost. These strategic consultations could guide your employees toward their financial goals and long-term stability.

9. Implement employee-friendly loan programs

On that same note … Navigating through significant life events often entails a financial commitment that an employee's current finances may not support. This is where you can intervene, in a good way. Implement a loan program that offers low or zero-interest loans for events such as further education, house purchases or anything else you’ve identified that would be beneficial from speaking to your employees.

10. Establish peer-led financial support groups

Workplace culture thrives when employees feel like they're part of a community. One effective way to achieve this is by facilitating the creation of financial support groups. Enable spaces — both digital and physical — for employees to gather and share financial tips, budgeting hacks and investments, as well as retirement planning advice. Don’t get us wrong, these shouldn’t be moan-and-groan sessions. They're meant to be empowering meetups where employees can voice how they've successfully tackled debt or navigated the minefield of first-time home buying. The groups could even invite guest speakers, from tax advisors to investment gurus, to deepen everyone's understanding of the financial world.

11. Incentivise smart financial behaviour

Financial resilience is an ongoing process. Leverage this by setting up a rewards system tied to smart financial behaviours. For example, reward employees who complete a financial literacy course or reach a personal savings milestone with tangible rewards — say, a shout-out, company merch or gift cards. You should be celebrating too, because remember, it's a win-win; they make more informed financial decisions, and you get a more focused, less stressed workforce.

12. Tailor benefits to individual needs and financial concerns

We briefly mentioned this but we want to emphasise it again: Offering a one-size-fits-all benefit package is passé. The future is personal. Use anonymous surveys or individual consultations to understand the unique financial challenges each employee faces. Then, tailor your benefits offerings accordingly. Let's picture Sarah, who's dealing with a student loan, and Jack, who's saving for his first home. A contribution matching program for student loan payments would be ideal for Sarah, while a first-time homebuyer workshop would hit the mark for Jack. Each step is a stride toward more financial security.

Empower Employees With Wellness

So, you're sold on the idea of ramping up your team's financial resilience, but what about their overall wellbeing? Enter Wellics, the all-in-one solution designed to elevate your employees' wellness across multiple dimensions. With our highly personalized dashboards, each member of your team receives unique, tailored advice to conquer their wellbeing journey. And it doesn't end at personalization.

We integrate educational video modules on an array of topics, from mental health to proper nutrition, enabling employees to make informed life choices. What’s more, Wellics’ compatibility with wearable tech means real-time, accurate data is always within reach, allowing for more focused wellness programs.

On your end, as an employer, you’re granted access to a goldmine of analytics, providing actionable insights to fuel your organization's culture-related objectives. Plus, we offer the unique feature of customizable metrics, empowering you to measure the elements of wellbeing that resonate most with your company culture and goals.

When you invest in Wellics, you're entering a partnership designed to uplift the entirety of your workforce’s wellness. So why wait?